We just released our 2017 Industry Financial Study and it’s important for us to share industry benchmarking data to help you make data-based business decisions. Our data will not answer all of your questions or make all of your decisions for you but it will help to fill in your gaps as you get started.

The first question you’re likely to ask is….

Can I make money?

Just like with any other business, there are plenty of ways to lose money running a shared workspace. But with the right approach, shared workspaces are profitable. I saw an article in a popular magazine recently that stated that 65% of all coworking spaces are not profitable. That may be true for a particular sample size (specific geography, the size of space, product mix within space).

We surveyed operators that have been open for less than a year to over 20 years and only 6% of the 156 operators that provided an answer to this question reported that they’re not profitable. The median annual profit per square foot for our full sample is $8.57 (that’s per square foot per year).

The median annual profit per square foot for coworking spaces is slightly higher at $11.08.

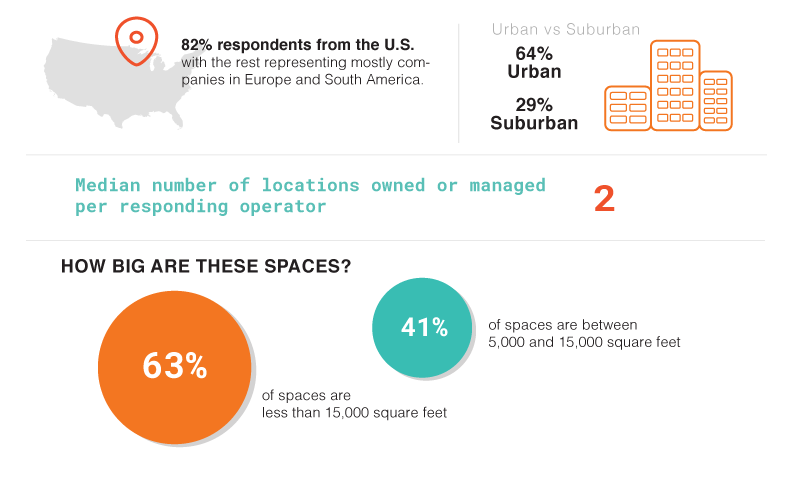

The profile of the operators we surveyed looks like this:

Where should I locate my coworking space?

Our takeaway on these data points:

- Urban spaces are more profitable despite higher median rents ($30/square foot in urban areas; $24 in suburban areas).

- Make sure you do your due diligence on the area within a 30-minute radius of your space. 80% of your members will come from this area. Make sure it’s full of small business owners, freelancers, and mobile corporate workers. Also realize that 30 minutes could be driving, walking, biking or public transportation. We didn’t ask for that detail in the survey (next year!).

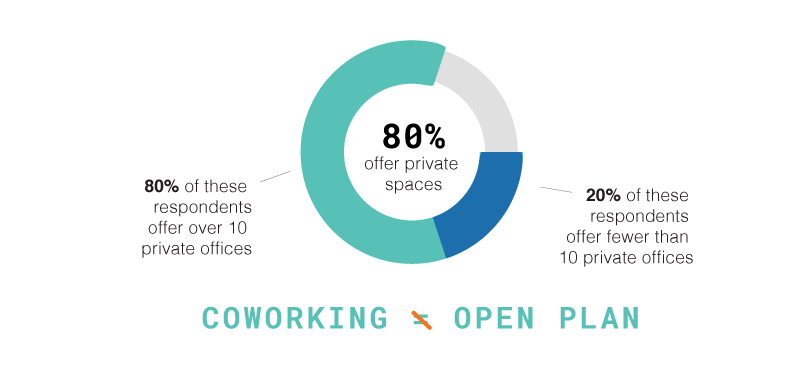

What should my product mix look like?

80% of coworking spaces reported offering private space.

Only 20% of our respondents reported fewer than 10 private offices, so 80% have more than 10 per location. This is likely a driver for profitability. In our executive summary of the report results, one of the trends we highlight is the explicit desire for productivity by members of shared workspaces. In most markets, we see high demand for private offices and members report that the #2 reason they join a shared workspace is for greater productivity. Productivity and desire for community and a collaborative environment are not mutually exclusive, but some types of work require doors and walls.

The #1 reason respondents cited for not closing a tour is “no private offices available.”

Many mobile workers spend a lot of time on the phone and need quiet areas to focus and produce. These may be the very same members that show up first for the lunch potluck or offer to host a lunch and learn. Coworking ≠ open plan and conversely, Coworking profitability likely = a strong mix of private offices/team suites.

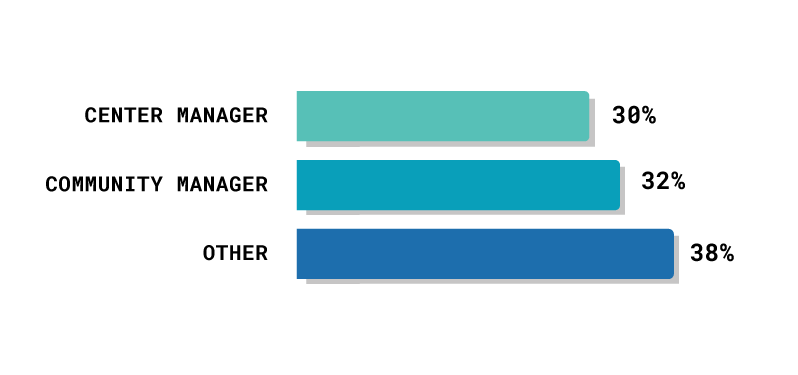

What are staffing costs?

Staff will be the second largest expense behind rent. Our survey showed a broader range of titles for the member-facing role than I had expected.

46% of member-facing staff are paid less than $40,000/year but 37% make more than $50k/year.

What size space should I operate?

We could not with a high degree of certainty determine that larger spaces are more profitable per square foot than smaller spaces. There are a lot of variables to consider:

- Build out costs (much higher for 16 offices vs. 8 for example)

- The liability of the monthly rent – you might sleep much better with a monthly rent liability of $10,000/month rather than $20,000

- Ability to fill a larger space

- Competition

- Market awareness

- Market demographics

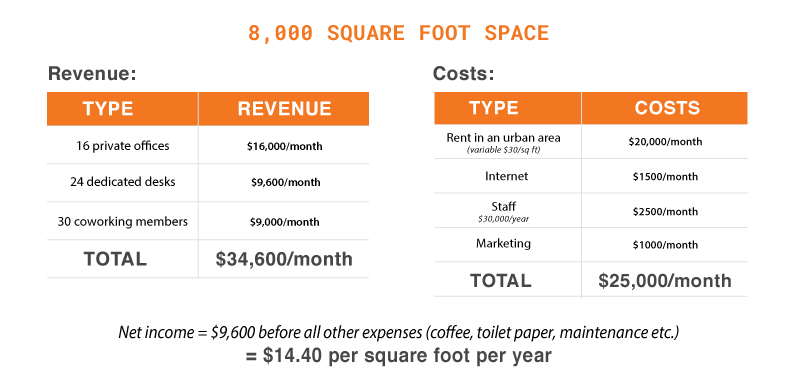

To help you consider the size question, consider the following highly simplified example:

Let’s compare the revenue potential and four largest costs for coworking spaces in a 4,000 square foot space and an 8,000 square foot space:

Again, this is a very simplified view because it only includes the largest expenses, resulting in a high net income per square foot. It’s also important to note that expenses like coffee, paper towels, toilet paper, etc. go up as your membership goes up so they are variable. But hopefully, this is still a good high-level exercise to help you think about the trade-offs of scale.

To get the full report, become a GWA Member and the report will be auto-delivered to you.

This summary was written by Jamie Russo

Executive Director of the Global Workspace Association

Host of the Everything Coworking Podcast

Founder of Enerspace Coworking